We believe that calculators should always be calculating. We build intelligent tools that transform how insurance professionals work. Our calculator is designed to save time, improve accuracy, and elevate your sales approach.

Key Advantages:

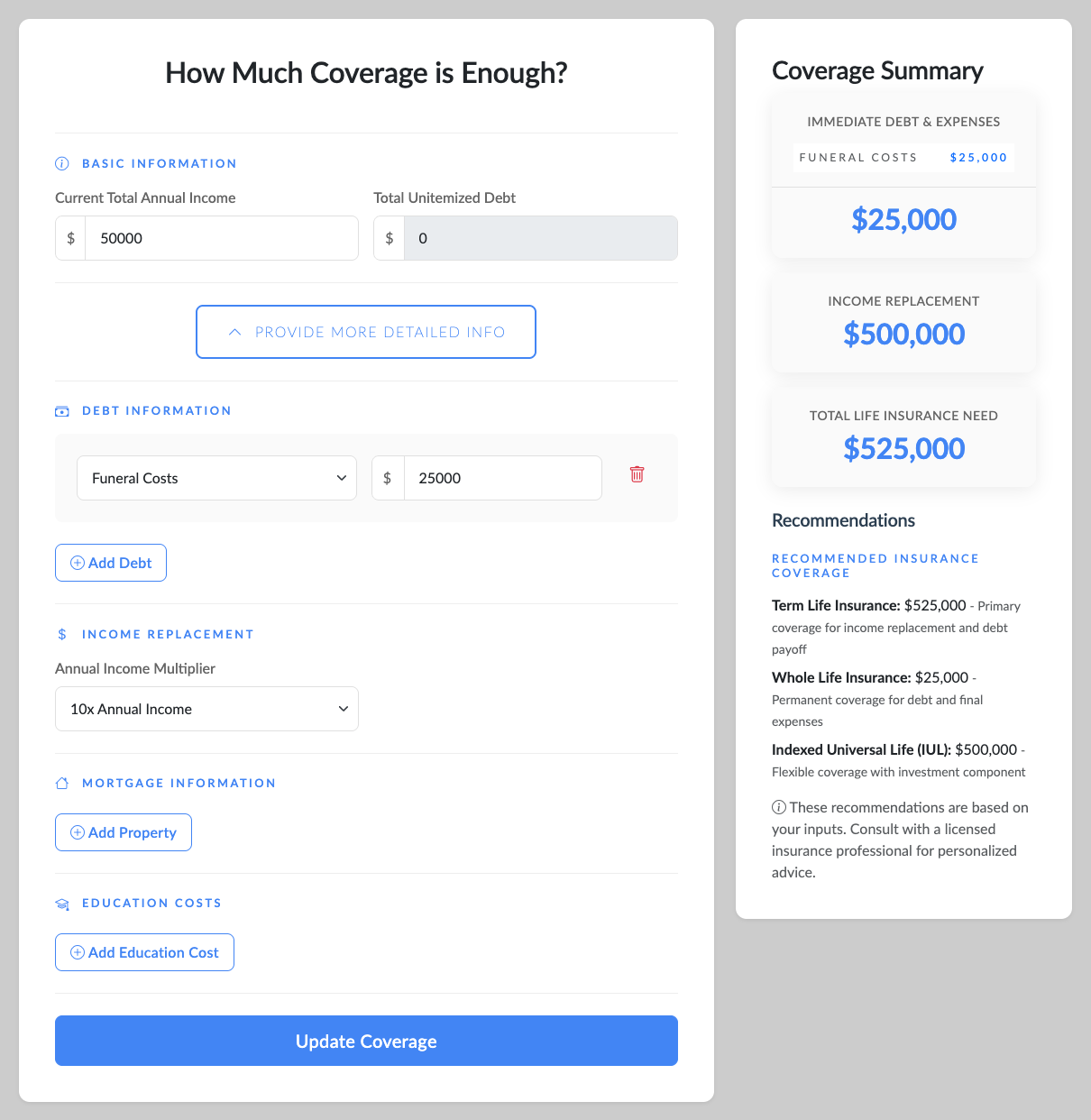

- Get a quick estimate using smart default values while retaining the power to dive deep into granular financial details. One tool, two powerful modes of analysis.

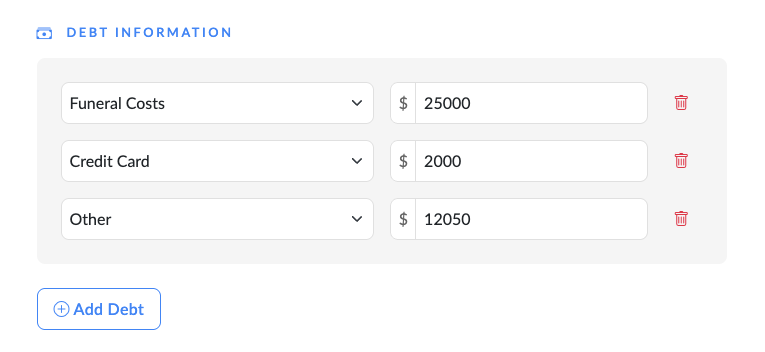

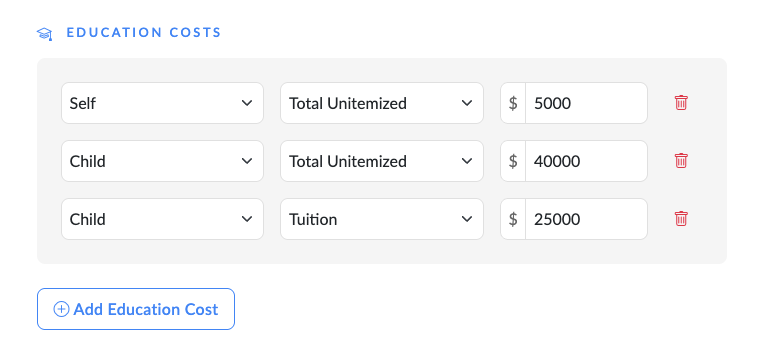

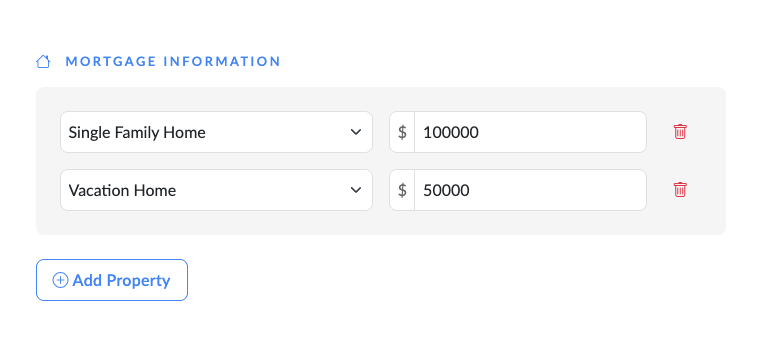

- Our dynamic running total provides real-time visibility into how critical financial factors—debt, income, mortgages, and education expenses—directly impact insurance needs.

- More than just a calculator, this is a learning tool. Trainees and agents can instantly visualize how financial variables reshape insurance coverage requirements, transforming complex concepts into clear, actionable insights.

Or, if you're using the Insurance Needs Calculator for training, it clearly conveys the impact of how someone's finances can affect their coverage needs at a glance. It shows them a level of clarity that can potentially turn a cold lead into a warm one.

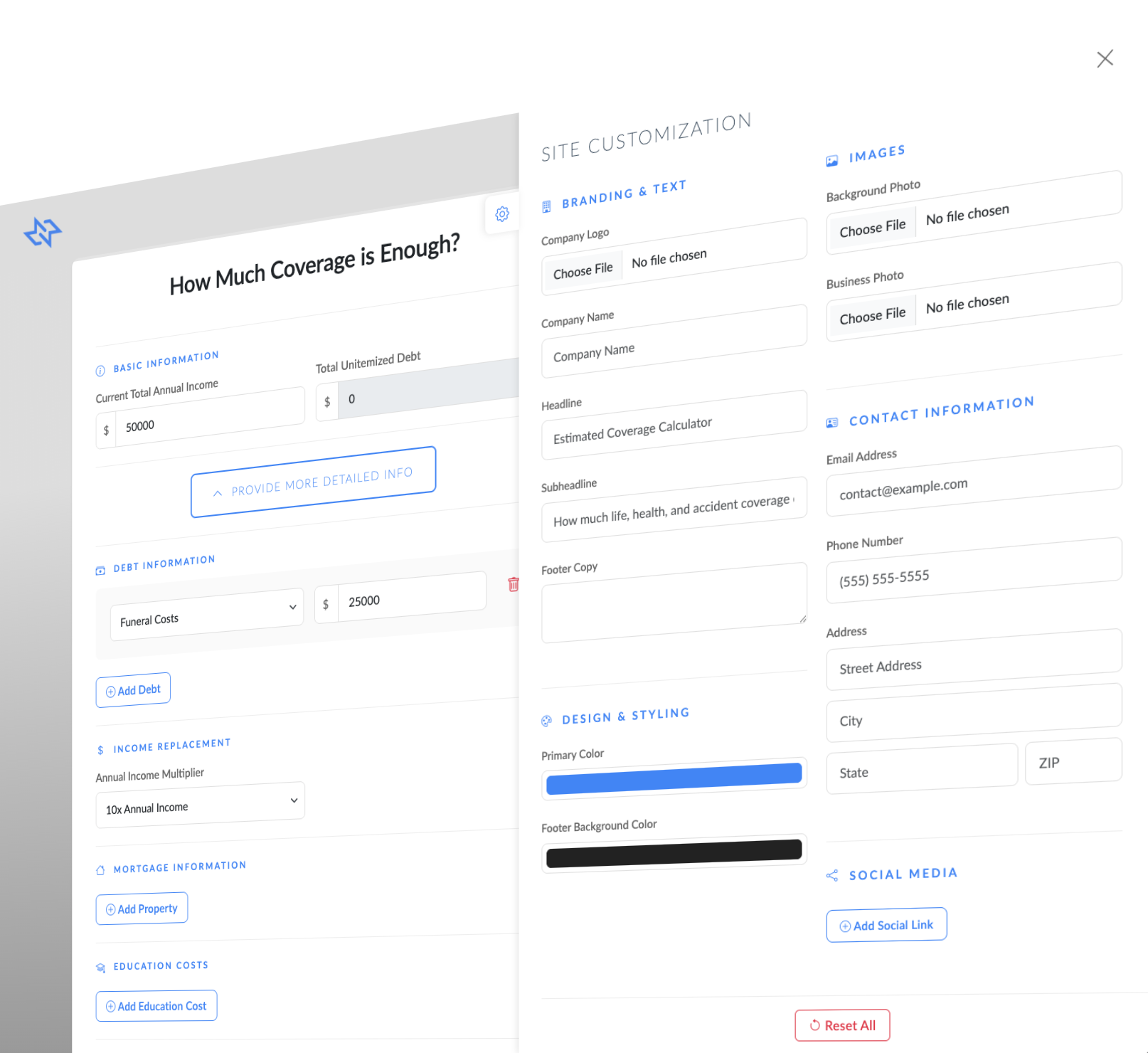

- Customize the calculator with your logo, brand colors, and photos to reinforce your brand's importance and professionalism.

- If you prefer a simpler, default interface, our calculator's user-friendly design ensures that even non-technical users can benefit from its powerful features.

Designed for Both Seasoned Agents and New Producers:

- Quick estimates for experienced professionals

- Comprehensive learning tool for new insurance producers

- Adaptable to various insurance product lines

Our Promise: Turn complex financial assessments into clear, compelling conversations that convert leads and develop top-tier talent.